Your cart is currently empty!

Who Am I & Why You Need To Trade?

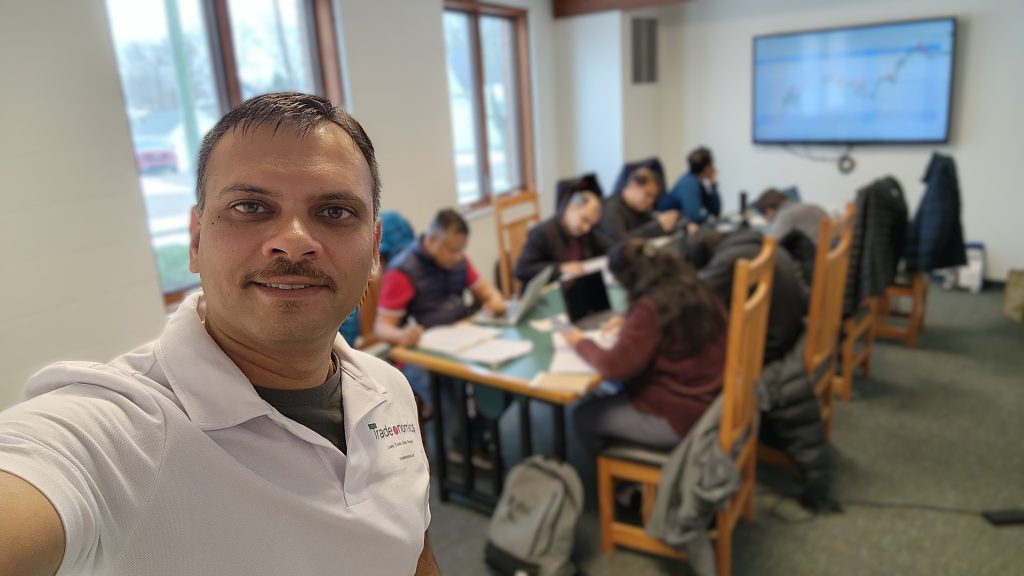

Nachiket Deshmukh

Founder & CEO @ Tradeonomics | Stock and Options Trading Educator | https://www.linkedin.com/in/deshmukhnach

Most people think trading is only for Wall Street insiders or math geniuses. The truth? It’s a skill anyone can learn with the right foundation, discipline, and guidance. In today’s uncertain job market, one layoff can erase years of stability. I teach people how to take control — by generating income independently, in as little as 30 minutes a day. Whether you’re in a career you love or planning your next move, financial flexibility is key.

After a fulfilling 20 year career in tech, and 17 years trading Stocks and Options, I shifted focus from building systems to building people — financially, mentally, and strategically.

Why You Need to Learn Trading Stocks & Options

- Financial Freedom: Relying only on a paycheck or a retirement account limits your growth. Learning to trade gives you control over creating additional income streams.

- Protection Against Uncertainty: Markets move every day. If you understand how to use stocks and options, you can protect your wealth instead of watching it shrink during downturns.

- Confidence Over Fear: Instead of being overwhelmed by headlines, you’ll know how to read the market, manage risks, and make clear decisions.

Why Am I Teaching Instead of Just Trading for Myself?

Yes, I Do trade for myself every day. But here’s the truth:

- Trading is a lonely business. Wins and losses happen in silence.

- I believe in multiplying impact. If I help 100 people gain financial confidence, that’s more powerful than me just quietly compounding my own account.

- Teaching makes me a better trader. Teaching creates community and shared growth. Explaining strategies forces me to stay sharp, disciplined, and accountable.

My Promise

I don’t sell “get rich quick.” What I teach is repeatable, disciplined approaches that anyone can apply with practice. My goal is to help you trade with confidence — and avoid the costly mistakes that I made starting out without education.

Yes, everything I teach can be found somewhere on the internet. But here’s the difference: I’ve spent the last 17 years living through the markets — making money, losing money, rebuilding, and learning hard lessons that no book or video can fully capture. My role is to save you from reinventing the wheel, by giving you proven strategies and the wisdom that only comes from experience.

Results

Over 60 people have already gone through my program in last few months. Many now trade confidently, earn consistently, and live without the fear of “what if.” There is no experience needed, just the desire to learn trading. Former students have reported earnings between $2k to $30k per month from options trading.